Third Party Risk Analyst Jobs – 3rd Party Risk Analyst Jobs: Managing External Vulnerabilities

Third Party Risk Analyst Jobs: Roles and Responsibilities

Introduction

Third party risk analysts are professionals responsible for assessing the risk associated with vendors, suppliers, and other third-party service providers working with an organization. They play a critical role in managing operational, financial, and reputational risks arising from third-party relationships.

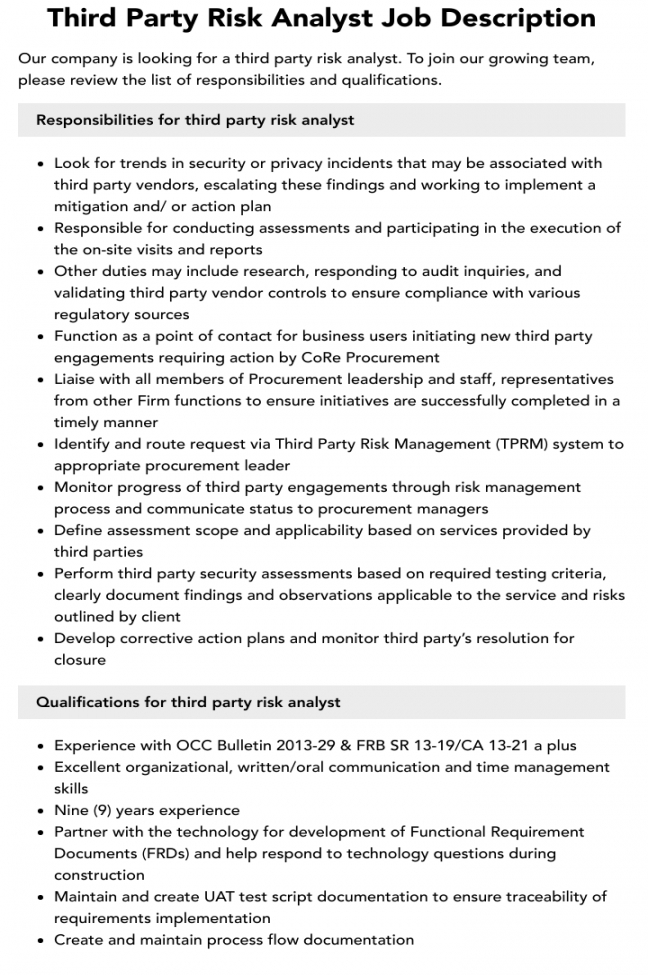

Roles and Responsibilities

1. Risk Assessment

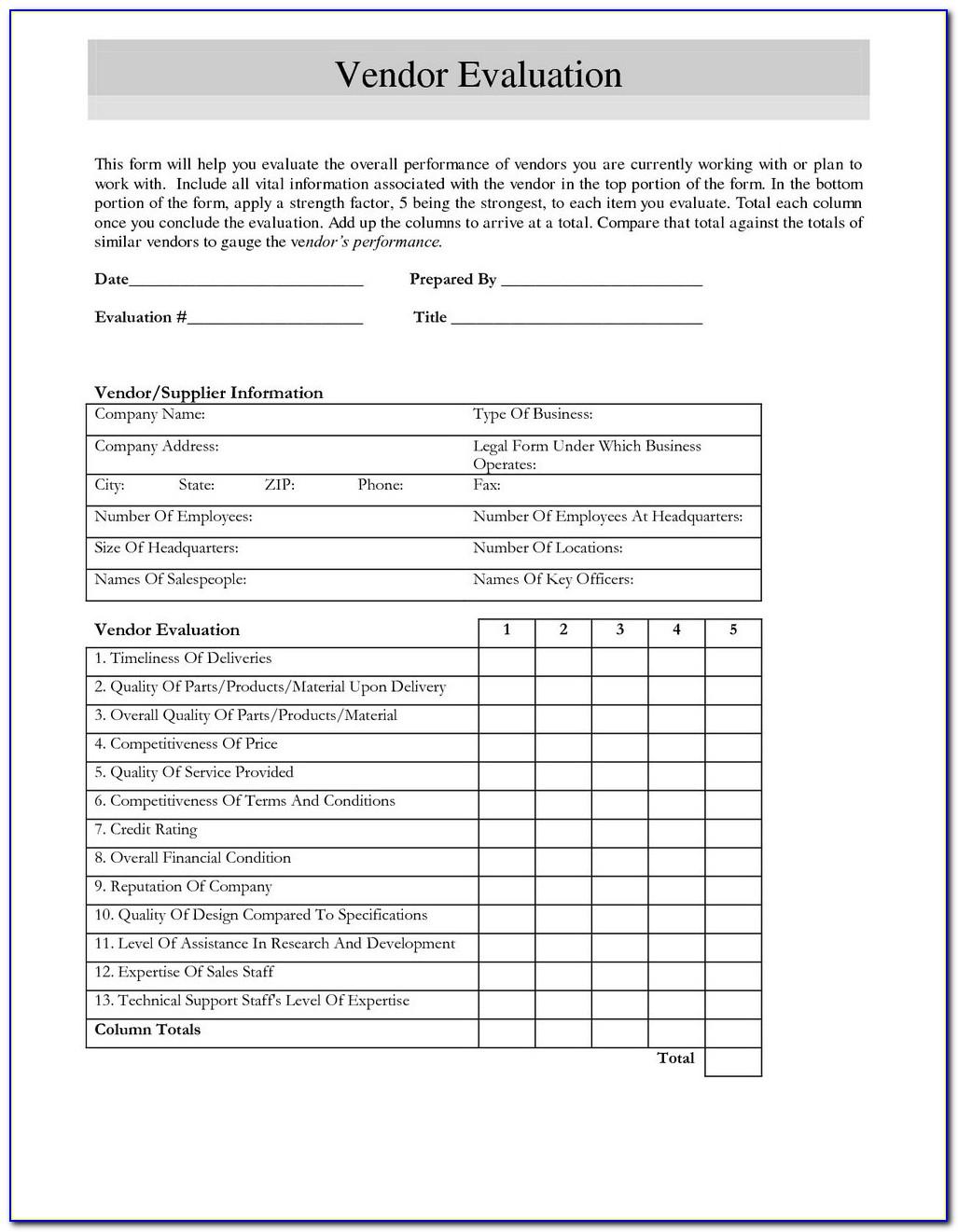

The primary responsibility of a third party risk analyst is to perform a comprehensive risk assessment of potential and existing third-party service providers. The process includes analyzing vendor contracts, financial statements, regulatory compliance, and security protocols to identify potential risks.

2. Risk Mitigation

After identifying risks, the third party risk analyst works with the vendor to mitigate the risks through effective controls, monitoring, and regular assessments. They also ensure that the vendor complies with organizational policies, procedures, and standards.

3. Risk Monitoring

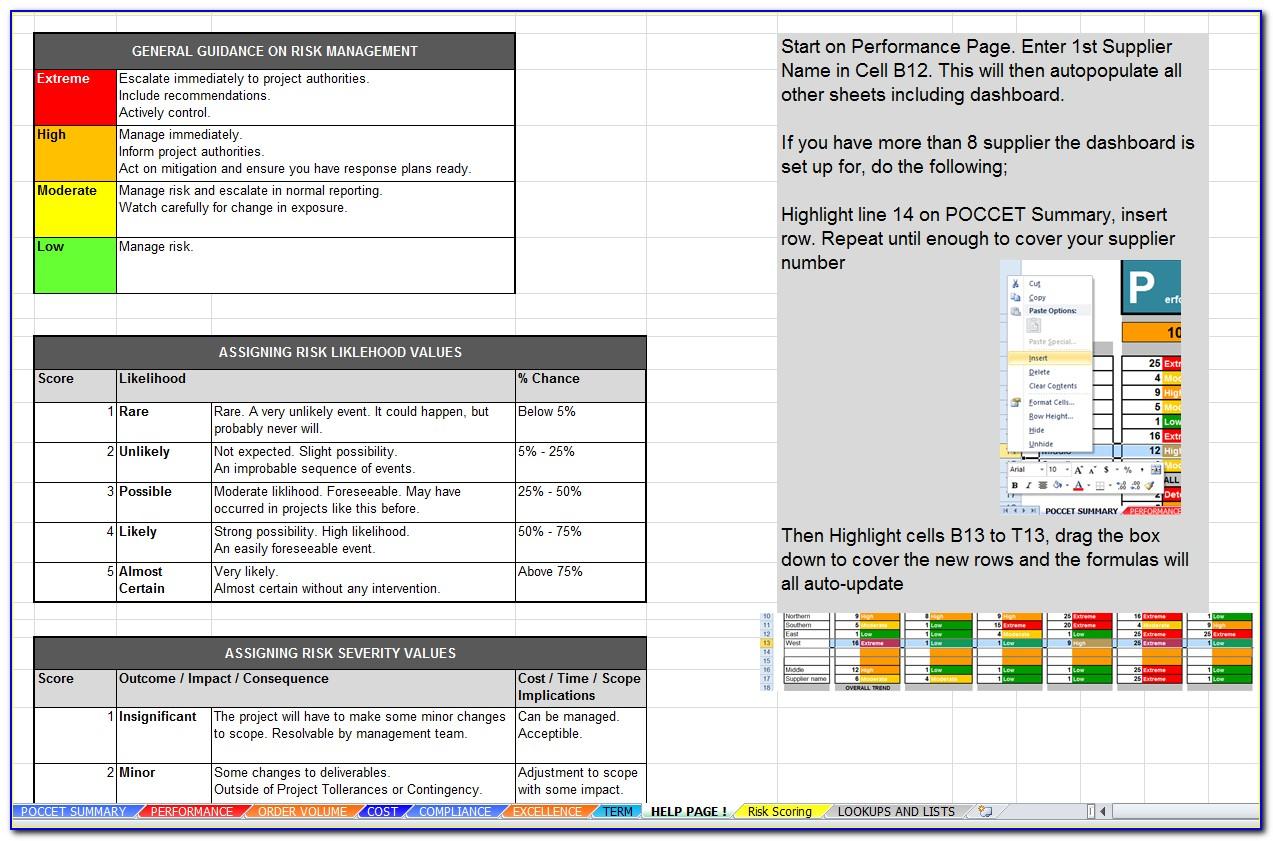

The third party risk analyst continuously monitors the vendor’s performance to ensure ongoing compliance with contractual obligations, regulatory requirements, and organizational policies. They also conduct regular assessments to identify any changes in the vendor’s risk profile.

4. Reporting

The third party risk analyst provides regular reports to senior management and regulatory bodies on the status of third-party relationships. They also develop and maintain a risk register to track risks and their mitigation actions.

Skills Required

1. Risk Assessment

A third party risk analyst should have strong analytical skills to identify potential risks and the ability to assess their impact on the organization. They should be familiar with various risk assessment methodologies and able to develop customized risk assessment frameworks.

2. Vendor Management

A third party risk analyst should have excellent vendor management skills to establish and maintain relationships with vendors and ensure that they comply with contractual obligations. They should also have experience in negotiating contracts and managing vendor performance.

3. Regulatory Compliance

A third party risk analyst should have a good understanding of regulatory requirements and be familiar with industry standards. They should be able to ensure that all third-party relationships comply with relevant regulations and standards.

4. Communication Skills

A third party risk analyst should have excellent communication skills to effectively convey complex information to senior management, vendors, and other stakeholders. They should also be able to present findings, recommendations, and reports in a clear and concise manner.

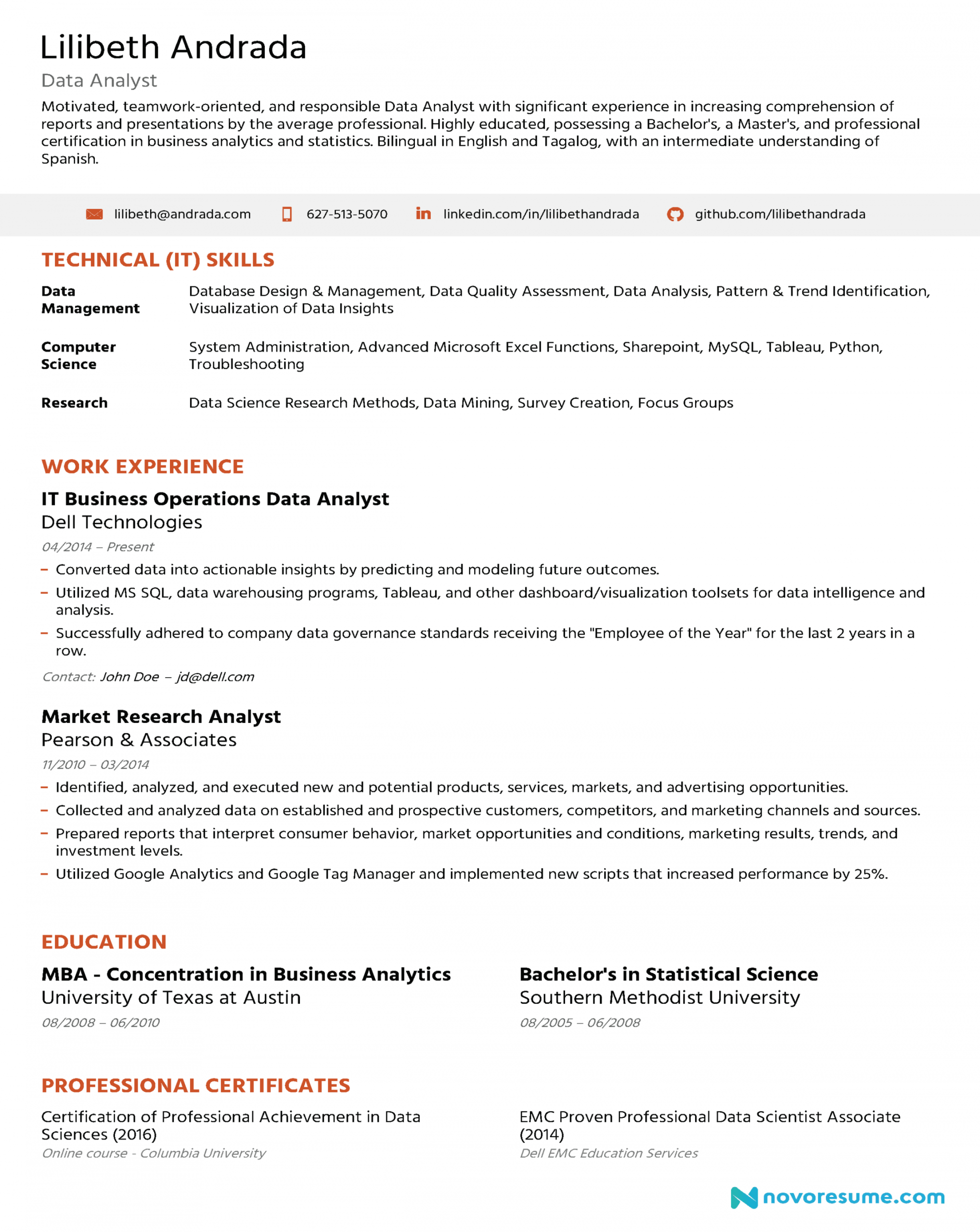

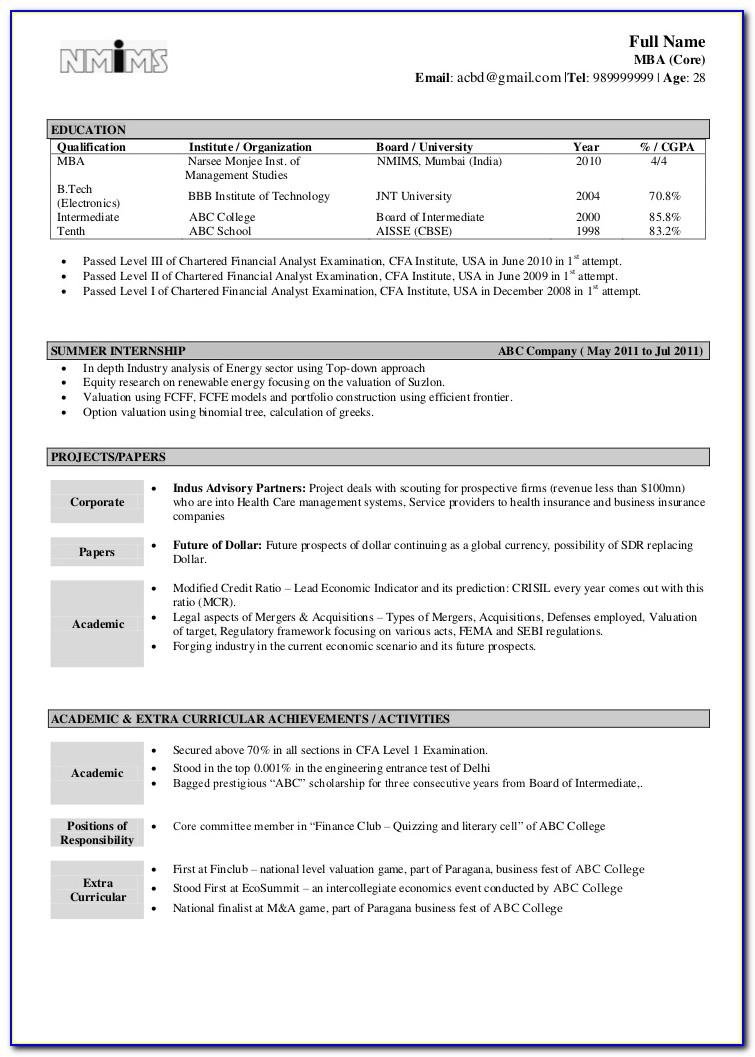

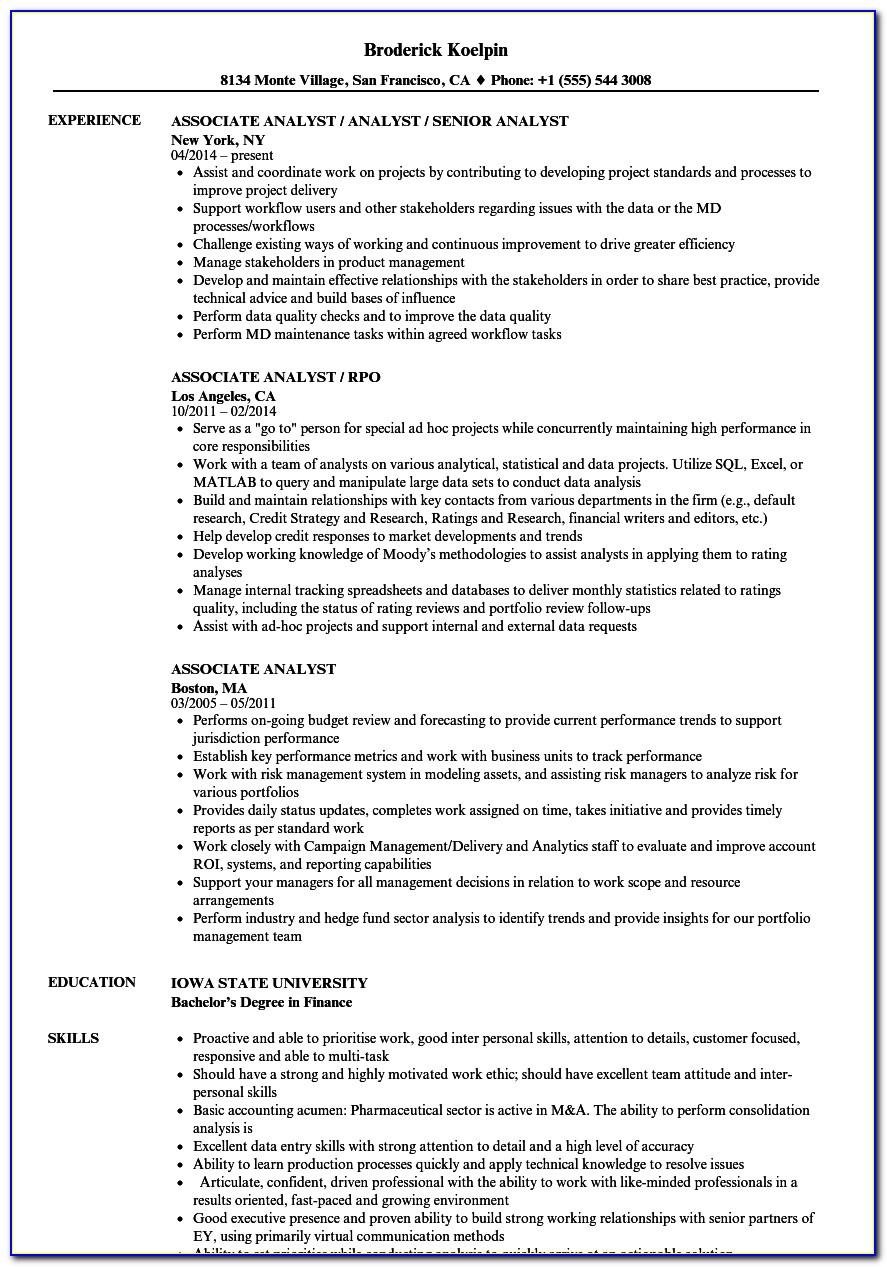

Career Path

Most third party risk analysts have a bachelor’s degree in business, finance, or a related field. Some organizations may require a certification in risk management or a related field. Entry-level positions may require some experience in vendor management or risk assessment. As they gain experience, third party risk analysts may become senior analysts or managers with the responsibility of managing a team of analysts.

Conclusion

Third party risk analysts play a critical role in managing risks associated with third-party relationships. They are required to have a range of skills including risk assessment, vendor management, regulatory compliance, and communication skills. If you are interested in a career in third party risk analysis, you should consider obtaining relevant education and certifications and gaining experience in vendor management and risk assessment.

FAQs

1. What is third party risk analysis?

Third party risk analysis involves assessing the risk associated with vendors, suppliers, and other third-party service providers working with an organization.

2. What skills are required to become a third party risk analyst?

A third party risk analyst should have strong analytical skills, excellent vendor management skills, a good understanding of regulatory compliance, and effective communication skills.

3. What is the career path for a third party risk analyst?

Most third party risk analysts have a bachelor’s degree and some experience in vendor management or risk assessment. As they gain experience, they may become senior analysts or managers with the responsibility of managing a team of analysts.

4. What are the key responsibilities of a third party risk analyst?

The key responsibilities of a third party risk analyst include risk assessment, risk mitigation, risk monitoring, and reporting to senior management and regulatory bodies.

5. Why is third party risk analysis important?

Third party risk analysis is important because it helps organizations identify and manage risks associated with third-party relationships, which can have significant impacts on the organization’s operations, finances, and reputation.

Tags :