When Do Loan Payments Resume After A Deferment Or Forbearance Period?

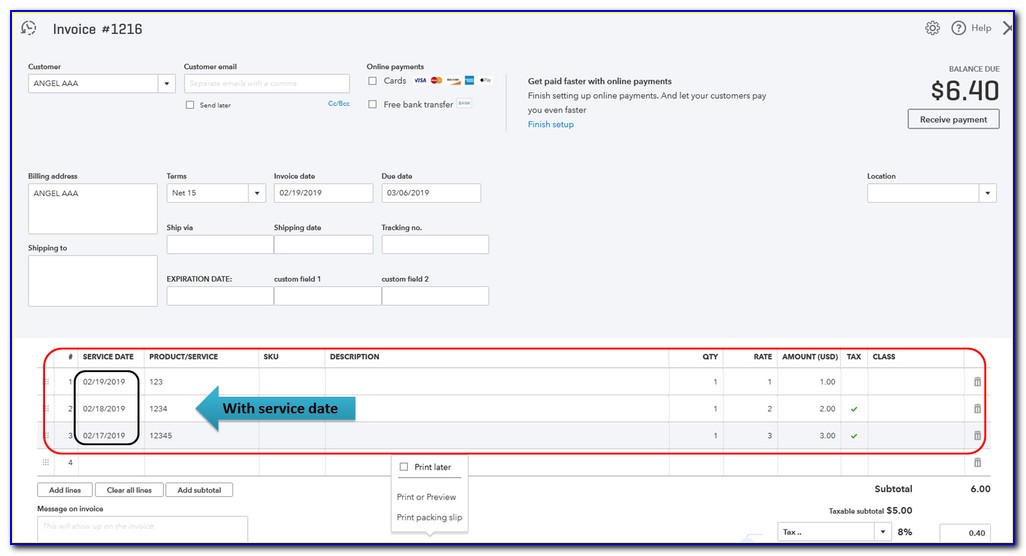

Image Source: windows.net

Are you wondering when loan payments will resume? With the ongoing pandemic, many people have been struggling to make their loan payments, whether it be for student loans, mortgages, or car loans. Fortunately, there have been some measures put in place to help ease the burden. In this article, we will discuss when loan payments are expected to resume and what you need to know to prepare for it.

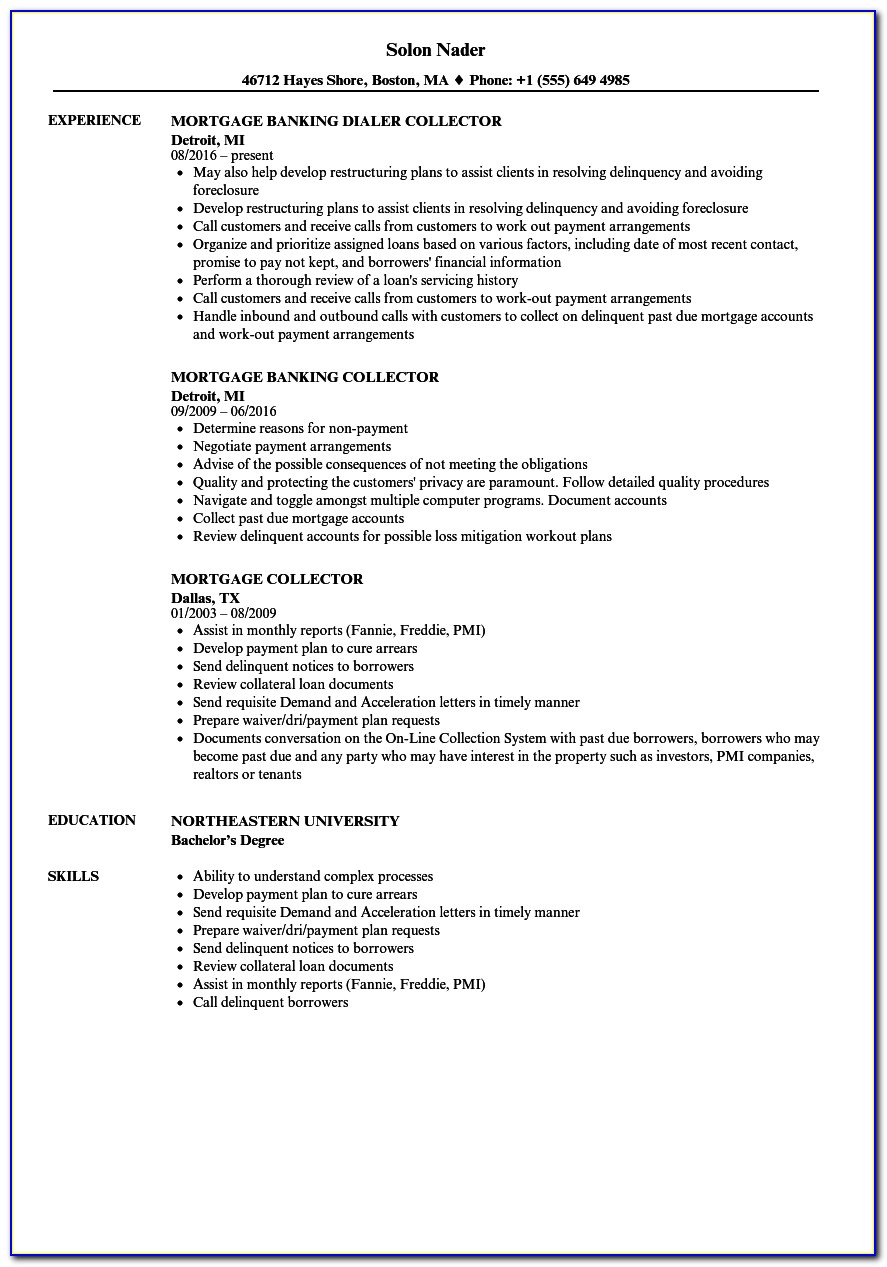

1. The current state of loan payments

As of now, many loan payments have been put on hold due to the economic impact of the pandemic. The government has passed a number of relief measures, such as the CARES Act, which allows borrowers to defer payments on federally-backed student loans until September 30, 2021. Similarly, homeowners with federally-backed mortgages can also request a forbearance of up to 180 days.

2. Student loans

If you have federal student loans, you can expect loan payments to resume on October 1, 2021. However, this may vary depending on the type of loan you have. Private student loans may have different repayment terms, so it’s important to check with your lender.

3. Mortgages

If you have a federally-backed mortgage, you may be eligible for up to 18 months of forbearance. However, you will eventually need to start making payments again. The exact date will depend on when you requested the forbearance and when your servicer approves it.

4. Car loans

Car loans are generally not covered under the CARES Act, so you may need to continue making payments as usual. However, some lenders may be willing to work with you if you’re experiencing financial hardship.

5. Credit cards

Credit card payments are not covered under the CARES Act, so you will need to continue making payments as usual. However, if you’re struggling to make payments, you can try contacting your issuer to see if they’re willing to work with you.

6. Personal loans

Personal loans are also not covered under the CARES Act, so you will need to continue making payments as usual. However, some lenders may be willing to work with you if you’re experiencing financial hardship.

7. Small business loans

If you have a small business loan, you may be eligible for relief under the Paycheck Protection Program (PPP) or the Economic Injury Disaster Loan (EIDL) program. These programs offer forgivable loans and low-interest loans, respectively.

8. How to prepare for loan payments to resume

If you’ve been taking advantage of loan payment relief, it’s important to start preparing for payments to resume. This means creating a budget and figuring out how much you can afford to pay each month. You may also want to consider refinancing your loans to lower your monthly payments.

9. What happens if you can’t make payments

If you’re still struggling to make loan payments after they resume, there are a few options available to you. You can try contacting your lender to see if they’re willing to work with you on a payment plan. You may also be eligible for forbearance or deferment if you’re facing financial hardship.

10. Common misconceptions about loan payment relief

There are a few common misconceptions about loan payment relief that are worth addressing. For example, some people believe that interest is waived during forbearance or deferment, but this is not always the case. It’s important to read the fine print and understand the terms of your loan.

11. How to avoid falling behind on loan payments

To avoid falling behind on loan payments in the future, it’s important to create a budget and stick to it. You should also try to build an emergency fund to cover unexpected expenses. And if you’re struggling to make payments, don’t wait until it’s too late to ask for help.

FAQs:

1. Will I have to start making payments on my student loans again after September 30, 2021?

Yes, if you have federal student loans, you will need to start making payments again on October 1, 2021.

2. Will interest be waived during forbearance or deferment?

It depends on the type of loan you have. Some loans may accrue interest during forbearance or deferment.

3. What should I do if I can’t make loan payments after they resume?

You can try contacting your lender to see if they’re willing to work with you on a payment plan. You may also be eligible for forbearance or deferment if you’re facing financial hardship.

4. Are credit card payments covered under the CARES Act?

No, credit card payments are not covered under the CARES Act.

5. What can I do to avoid falling behind on loan payments?

Create a budget, stick to it, and build an emergency fund to cover unexpected expenses.

In conclusion, loan payments are expected to resume in the coming months, so it’s important to start preparing now. Whether you have student loans, mortgages, car loans, or other types of loans, it’s important to understand your options and create a plan to avoid falling behind on payments. If you’re struggling to make payments, don’t wait until it’s too late to ask for help. There are options available to you, such as forbearance, deferment, or payment plans, that can help you get back on track.

Tags :